To achieve consistent, strong results in the market, you have to make sure that you are repeating a defined process that accomplishes the two goals of screening.

1. Finding High Potential Ideas

2. Assessing the Market Health

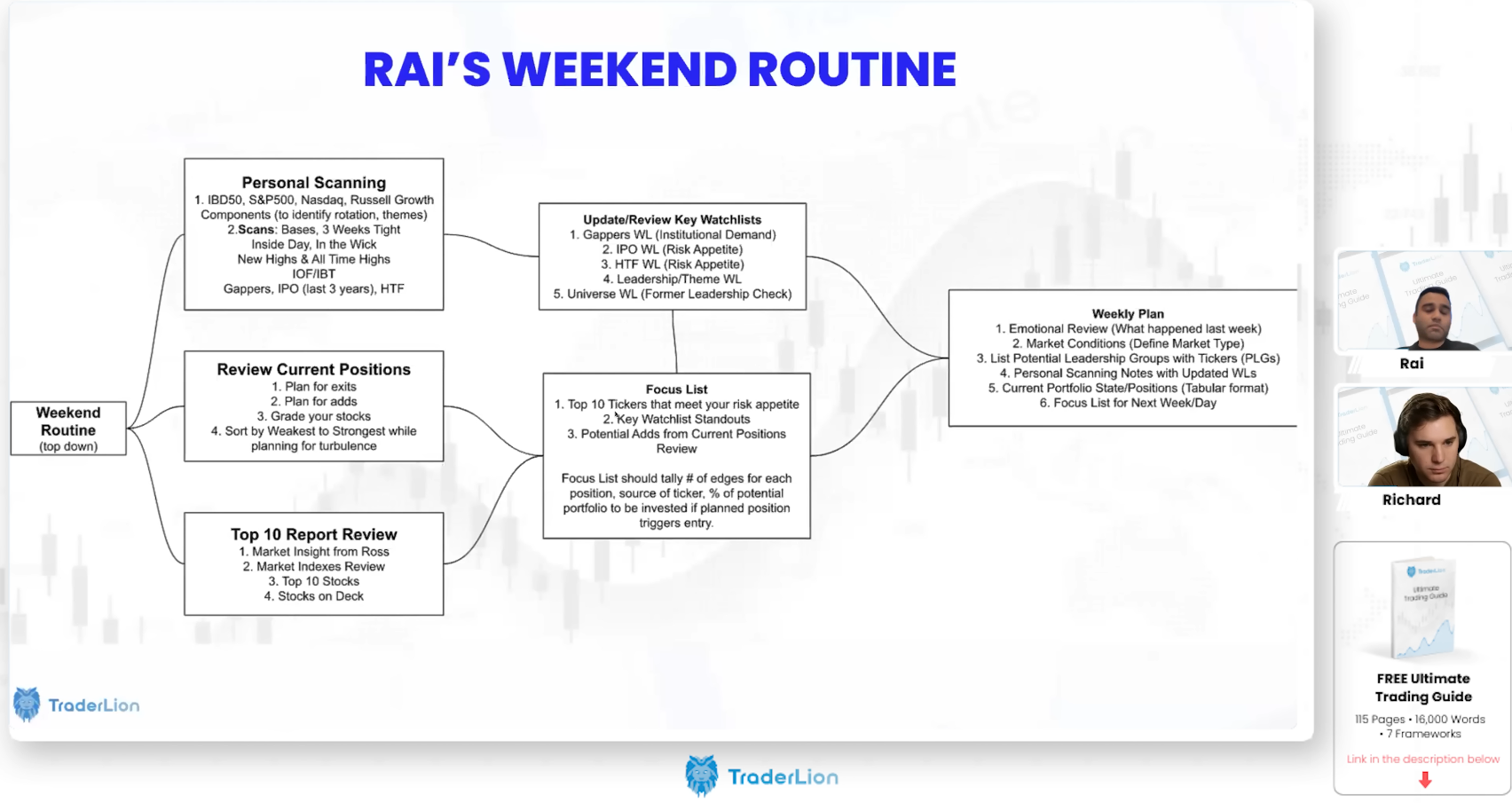

To do this, here is the general framework for a weekly routine that we recommend.

1. Analyze your actions from the past week. Write down any lessons

2. Analyze the general market indexes

3. Go through your universe screens

o Save any ideas to your watchlists

o Note any trends and themes developing

4. Refine your watchlists

5. Build your weekly focus list

6. Go enjoy your weekend

There are many ways to tweak this template to suit your style but we hope that this general framework serves as a good foundation for you.

We’ll be covering the refinement process and steps 4 and 5 in depth in a later email. They is a crucial part of the screening routine.

Also don’t forget number 6!

Time away from the screens is extremely valuable not only for your life but to reset your mind and trade effectively the next week.

Building your Stock Universe

What is a stock universe? Well it is generally a list of all the stocks that meet your widest criteria for a potential trade.

You should look to have around 400-500 names that form your universe.

Too much more than that and the work becomes tedious and you are likely looking at many subpar charts.

Too much less than that and you will be eliminating promising charts.

Once you have this universe, you want to either spacebar through each of the charts manually, or run tighter screens on this list.

Using Screens to Build your Universe

Let’s now cover some excellent universe screens that you can use for growth style trading. We’ll share the specific criteria we use and why.

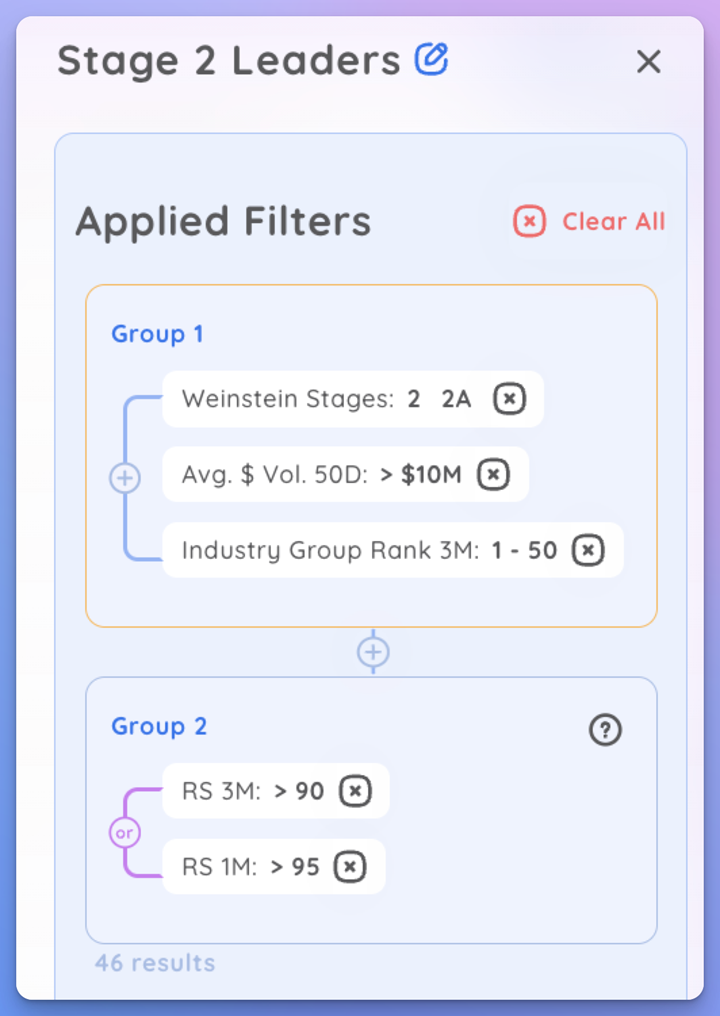

Stage Analysis Leaders Screen

This screen looks for stocks in early stage 2 uptrends that are in leading groups and either among the strongest stocks this month or over the past three months.

The idea is to incorporate Stan Weinstein’s methodology and look for leading stocks in leading groups.

It typically returns around 100 stocks.

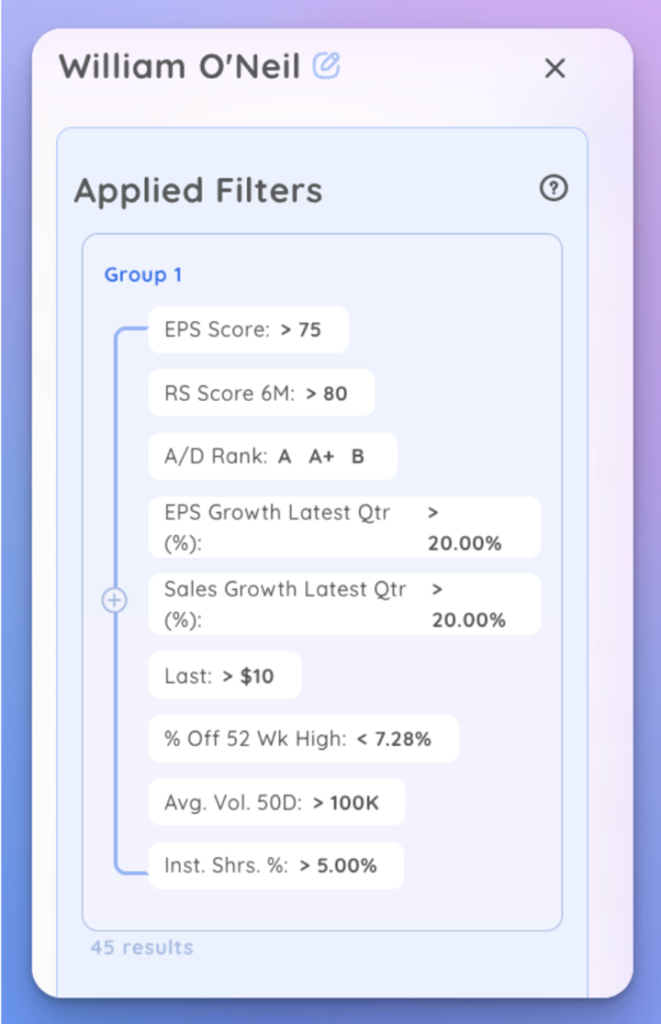

William O’Neil CANSLIM Growth Screen

This stock incorporates the criteria that William O’Neil used to find True Market Leaders. It looks for stocks with strong earnings growth, relative strength, and near highs.

It typically returns less than 50 stocks to go through. This is a built in preset in Deepvue

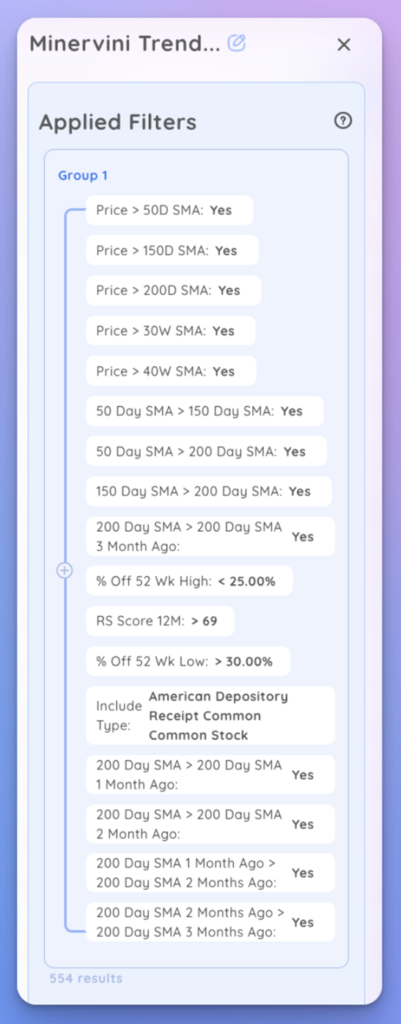

Minervini Trend Template Screen

This screen is inspired by Mark Minervini’s Trend Template criteria. It looks for strong stocks that are in trend.

We have different presets that look for early to established trends: 1 Month to 5 Month Variations.

The Deepvue Universe Screen

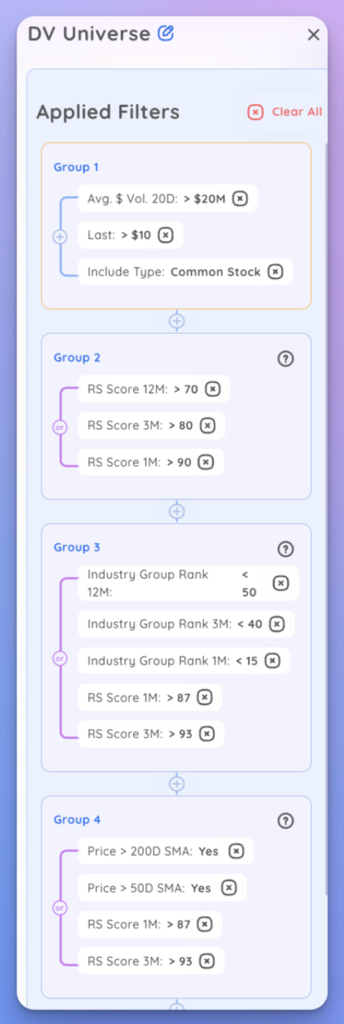

This is the first screen that we review on the weekends. It looks for reasonably liquid stocks that are in strong trends and/or in top industry groups.

This screen makes use of the And/Or Filters in Deepvue. These allow for added flexibility when screening since you can add “Or” conditions where only one needs to be true for a stock to pass through.

You can learn more here: https://www.youtube.com/watch?v=X0dY3MJozdE

This is a built-in screen in Deepvue and usually returns about 300 stock ideas.

Take action

What you should do is choose 1-2 of these screens and make them your own.

Tweak them so they best fit the types of stocks that you trade. If your schedule only allows you to review 250 charts, tighten the criteria to suit your routine.

Review these screens weekly and consistently train your eye to look for the best names that they turn up.

Key Points to Remember

Today we covered the core framework of a weekly routine and introduced 4 screens that we use to build our Universe.

Remember that you should make these screens your own.

If your schedule only allows you to review 200 stocks, tweak the criteria so on average the screen returns around that many.

Tailor the screen to fit your own style and timeframe, that is the key to developing a weekly process that will help you outperform over the long haul.

We’ll see your tomorrow as we dive into building a daily sorting and screening routine that provides constant idea generation.