Secular themes and trends are yet another area that investors must watch to understand long-term investment potential.

We constantly look for major shifts and themes that will take years or even decades to be played out. We then note the companies that are benefiting from these trends. When they begin showing explosive growth in earnings, our analysis is confirmed. We buy them, in most cases, when they meet our emerg-

ing trends and our selection criteria

That is where we can improve our odds of picking a really top winner—when a stock meets our growth, value, institutional, low debt, leading relative strength and earnings growth, strong balance sheet, bull market, and other criteria, and it also is benefiting from some of the emerging trends we foresee.

1910

Buggy makers and cigar stores.

1920

Aviation, oil, ice, and closed-end investment trusts.

1930

AT&T, higher yielding utilities, no-debt f inancials with earnings.

1950

Uranium, bowling chains.

1960

Conglomerates, recreational vehicles.

1970

Nifty fifty, OTC growth, oil, gold stocks.

1980

Junk bond promoters, REITs, Japanese stocks, discount distributors of goods, PC software, hardware, electronic supplies, pharmaceuticals.

1990

Medical, biotechnology, capital goods, software, telecommunications, communication software and hardware, health maintenance organizations (HMOs),

financials, emerging markets and debt, Internet companies, cigar manufacturers.

To understand investment trends, you need to understand basic economics and human nature.

The new high list of 52-week new highs for each country is also a good place to look for new themes. Serious investors should

always monitor the new high list. Whenever you find a number of stocks in a particular or new industry, that should be a wake-up

sign that something is happening in that industry or sector.

Is it a sustainable trend that will allow this sector or industry to continue being a top relative strength area? Is there fuel behind it?

The new high list is also a good area to watch for stocks that might meet our selection criteria

Two places to consistently locate excellent themes and trends are involved in these real-life examples: (1) the filling of technology

gaps as a technology is beginning to be implemented but not yet widely utilized; and (2) a company whose business lies in the

path of strong demographic trends.

The first example is one of the most profitable investments we ever made for funds we consult for: Cisco Systems, a company

that was filling a huge technology gap.

Once the Gulf War conflict was leading to an easy victory in early 1991, a new bull market emerged in stocks. The bond and

T-bill market moved above their respective 200-day moving averages in October 1990, while stocks followed in January 1991.

Shrewd investors began looking for companies experiencing rapid earnings growth. A little-known stock called Cisco Systems

met our criteria and intrigued us because it showed triple-digit earnings growth over the prior three quarters, and it was still rel-

atively undiscovered, having just gone public the year before. As we looked further back in Cisco’s history, we found that the com-

pany had actually experienced triple-digit quarterly earnings growth every quarter since late 1989! Certainly there had to be

one heck of a story here.

f you look over the past century of data, you will find that

each decade produces at least one bull move in stocks enough to

produce many “meteors” whose stock prices explode up 300 per-

cent or more in a one- to three-year period. These fad stocks start

out by showing strong consistent or turnaround earnings growth

(defined rigorously later in this chapter), then begin to take off in

price and become strong relative strength stocks as they are start-

ing to be discovered, and then in the final one third of their price

movement they become “darlings” of Wall Street and get wildly

overvalued and overowned by institutions prior to collapsing back

into relative obscurity and fairer valuations based on much slower

earnings growth. These are the meteors of the stock market.

However, you will also find historically, that each decade pro-

duces at least one bull move in which a handful of “fixed stars”

develop. Just like meteors, these fixed stars start out by showing

strong consistent or turnaround earnings growth (defined rigor-

ously later in this chapter), then begin to take off in price and be-

come strong relative strength stocks as they are starting to be

discovered, and often also become popular with the Wall Street

crowd. Fixed stars may become overvalued, but very rarely be-

come wildly overvalued. What really differentiates fixed stars is

that while their earnings growth slows some, they are still able to

produce more than 40 percent annual earnings growth for over a

decade. Because of their continued strong growth and lack of high

overvaluation, these stocks do not collapse, they just begin to

move up with more volatility and at a slower rate than their initial

prepopularity phase.

- Hunt for strong earnings growth and runaway characteris-

tics (both of which we will be describing specifically ahead)

in stocks Wall Street hasn’t yet completely discovered.

- Trade these stocks (rather than invest, buy, and hold) using

limited risk pattern recognition strategies for entry/exit/OPS

(Open Protective Stop), and get out (at least partially) when

institutions begin to dominate trading in the stock.

- Take partial profits when these stocks begin to get slightly

overvalued and then tighten up trailing stops and look to

exit completely on the first sign of serious weakness.

Criteria for Runaway up Stocks with Fuel

Technical Strength. This means that the stock has exhibited run-

away characteristics via our 5/21 method at some point since the

trend in question began. It also means the stock has not fallen below

its 200-day moving average (MA) once its trend has begun and it has

moved above the 200 MA. Finally the stock must have an O’Neil’s

Relative Strength rank of at least 65 if it is undergoing a correction, and

at least 80 if it is making new highs. This ranking is available from

Investor’s Business Daily or Daily Graphs.

Consistent Growth or Turnaround Growth. Consistent growth means

(1) the stock has a five-year annual growth rate of 25 percent or

higher; and (2) three years of higher annual earnings or two years

of higher annual earnings and a next year’s estimate of higher

earnings than the current year. OR

Turnaround growth means (1) the last two reported quarterly

earnings showed earnings up 70 percent or more over year-earlier

same quarters, and (2) this quarter’s earnings are above last quar-

ter’s earnings.

Strong Quarterly Earnings Growth, Earnings Momentum, and Top Earn-

ing Per Share (EPS) Ranking. Strong quarterly earnings growth

means that both this quarter and the last quarter show earnings up

25 percent or more over year-earlier similar quarters. AND

Earnings momentum means that either this quarter’s earn-

ings are higher than last quarter’s earnings or that this quarter’s

earnings are up over year-earlier similar quarter by a higher

percentage than last quarter’s earnings were up versus last quar-

ter’s year-earlier similar quarter. Put simply, this quarter’s earn-

ings growth rate is higher than last quarter’s earnings growth

rate. AND

Top EPS rank means an Investor’s Business Daily or Daily Graphs

EPS ranks over 80.

Reasonable Price. Criteria are:

- P/E is 70 percent or less of the lessor of (a) a stock’s five-

year growth rate (unless the stock is a turnaround growth

pick and not a consistent growth pick, in which place the

growth rate criterion here does not apply), or (b) the lower

of the quarterly earnings growth rate of the last two quar-

ters; or the P/E is 50 percent or less of the stock’s antici-

pated growth rate of the next year via analysts consensus

estimates. AND

- P/E is not twice the S&P’s P/E or greater. AND

- Price/Sales is not > 6.

The bottom line for this criterion is that the stock is not

overpriced (items 2 and 3), and that it is selling at a dis-

count to either its current growth or its expected growth

rate.

Relatively Undiscovered Stock.

The combined (bank and fund) insti-

tutional sponsorship of the stock should be ideally less than 16 percent of

capitalization. If a stock meets strong themes and trends one can buy

it until institutional sponsorship reaches 35 percent, but don’t add

to it thereafter. In addition, investors should begin taking profits

once a stock reaches 40 percent or higher institutional sponsor-

ship. These figures are to be found in O ‘Nell’s Daily Graphs, and in

the charts of Investor’s Business Daily.

Low Debt. The strongest companies use their own internal growth

to finance their expansion. This means long-term debt less than 50

percent, actually less than 10 percent in most top stocks. You can

relax this qualifying criterion only in specific instances. The two

main such situations are when you are trying to exploit a clear sec-

ular theme or trend and none of the stocks in that industry meet

our criteria but there are one or more that meet all the criteria but

low debt. The second instance is when all the companies of the in-

dustry in which a stock competes have very high debt levels; in

some industries even the best companies need high debt.

Positive Fundamentals and Ratings. Positive fundamentals means

that there is a simple, straightforward reason to expect continued

earnings growth such as a new product, a technology gap being

exploited and not yet fully in use by its expected market, a change

in management and anticipated results from restructuring, demo-

graphic trends expanding the market, or changes in interest rates

or economic environment. You should be able to explain to an un-

interested party in plain language why the stock should continue

to experience sharp earnings growth for the next few years.

Positive ratings means that if the stock is followed by premier

stock rating services such as Value Line, Zachs, or Lowry’s that it

has a top or second-to-top rank in most of them and does not have

a less than average rank by any of them. You do not need to sub-

scribe to all these services, but you should probably subscribe to

one of them or else get our own Portfolio Strategy Letter, which

screens stocks in this way for you.

Maintenance of Acceptable Risk. Cut risk to original capital and

overall risk once any potential problems develop in each market

and stock. In our money management rules, you will normally

risk up to 2 percent of capital on each position from entry to OPS.

If there is any reason for caution, however, you should cut new risk

to 1 percent on any new positions or additions. Reasons for cau-

tion include (1) the stock itself does not meet new buy criteria be-

cause it is no longer reasonably priced or no longer undiscovered;

(2) the overall country market that the stock is based in is becom-

ing overvalued or technically questionable, or interest rate trends

are no longer clear; (3) top timing models such as the Chartist or In-

ternational Bank Credit Analyst are cautious or negative on that

overall market; and (4) the stock is a takeover rumor or takeover

target where the investor doesn’t have inside information.

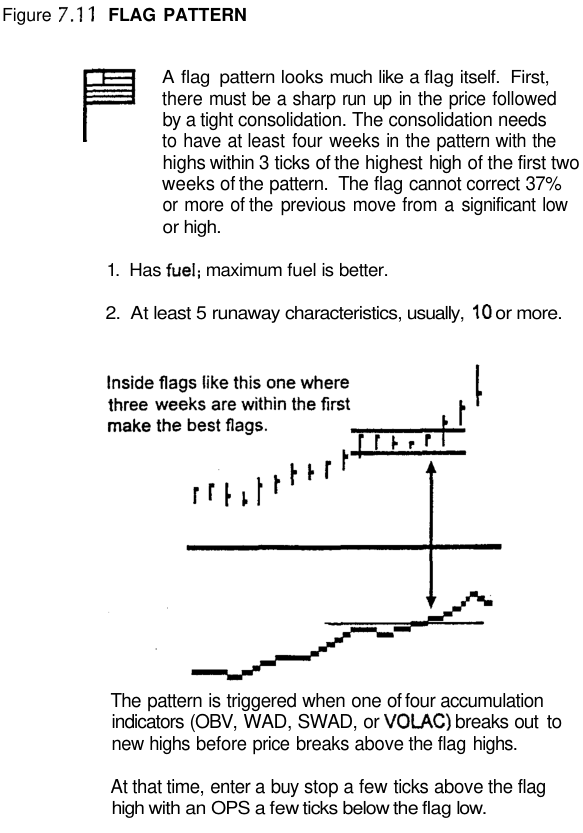

Volume Accumulation Indicators Used in Chart Patterns

• On-Balance Volume (OBV). OBV starts at zero and adds total

volume to a cumulative total each day that closes higher

than the previous day, and subtracts total volume each day

hat closes lower than the previous day. Add volume each

day that closes higher, subtract volume that closes lower,

and keep a cumulative total.