There are 3 instances in the past 25 years where the NASDAQ first crashed and then had a huge, relentless V-shaped recovery, up 40%+ in 3 months, surfing the 10/20 SMA for the whole move.

1998

2009

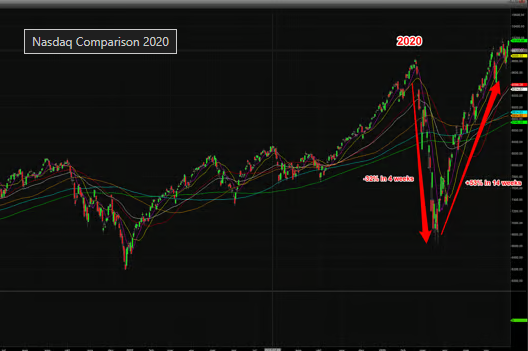

2020

Since the 2009 instance was after a multi-year bear market I will not include that one.

The 1998 and 2020 scenarios are very comparable since both occurred after 10 years of a secular bull market.

Let’s look at the charts. Again, 1998 and 2020 look very similar in both the duration and magnitude of the down and up moves.

What am I trying to say here?

Since n=1 we don’t have much data to go on but the main thing to take away from this is the market doesn’t HAVE to crasch or even have a significant pullback just because “we are up too much too fast” or “it all doesn’t make sense” or “look at the macro” or this or that. We’ve been hearing those same arguments for 10 years now.

The pullbacks could be limited to 5-8% for a long time. Look at 1999 and how well the NASDAQ digested every pullback and found support on the rising moving averages.

I’m not saying things are going to play out exactly like this and I definitely don’t think we are going to have a parabolic like we had late 1999 to early 2000.

Now obviously we could have a second crasch around the corner, that’s why we always use the 10/20 SMA as our guide on the leading momentum stocks as I repeat daily on the stream.

It always pays to study historical moves in the markets instead to be clueless and let your emotions, biases, fear or anger guide you.

I see some people on Twitter, a few with huge following that are angry, frustrated and bitter that the markets keep going higher.

Good luck!