Dan Zanger Says… Follow the Leader

March 29, 2007

The Stock Master Shares His Secrets

By Matt Blackman

It is not often that traders get a crash course from a legend, but they had that opportunity recently. On May 14, more than 100 attendees gathered to hear the world record holding stock trader speak at a conference in Los Angeles. They weren’t disappointed and listeners were kept on the edges of their seats for more than 7 hours as Daniel Zanger spun his magic. As an added bonus, they also got to hear a presentation by Stan Ehrlich on learning how to identify powerful commodity cycles and chart patterns and profit from them.

Zanger first came to public attention when he was featured in a Fortune magazine article in December 2000 entitled, My Stocks are Up 10,000%! The truth was even more amazing. He became the unofficial stock trading record holder in 2000 by transforming a $10,775 investment into $18 million in 18 months, which actually worked out to 164,000% in a year and a half. In 23 months his market nest egg had grown to a mind-boggling $42 million. He even has the tax receipts to prove it.

The pool contractor turned millionaire had developed quite a following in the process during the bubble heyday. On any given weekday from 1998 through 2000, you could find Zanger glued to his computer screens with laser focus surrounded by a half-dozen friends watching his every move on occasions. Without saying a word, he would remain poised like a hawk watching 40 – 60 stocks and waiting for the all-important breakouts from patterns on volume, calling his broker to buy and sell a stock when the time was right. This would go on from market open to market close. His audience would do their best to follow his every move in silent amazement. Today they are gone and he trades solo for the most part. Most of his friends just didn’t have the stamina or commitment, especially when the going got tough.

What did he talk about at the seminar? Much of the day was spent examining chart patterns and daily bars, but more importantly, seminar attendees had a chance to hear a detailed post mortem on each of his largest and best winning trade of the past 7 years.

When asked what are the keys to his incredible success, he simply replies, “chart patterns and volume, that’s pretty much it.” Volume is the real key for without a strong surge in volume, even the best pattern breakouts won’t go anywhere. Sounds simple but like all great success stories, it’s not so easy.

Those who subscribe to his newsletter, The Zanger Report and his member’s chatroom at Chartpattern.com quickly learn that it took Zanger years to become an overnight success. His clients range from private traders with small accounts to hedge fund managers trading millions and possibly billions of dollars and numerous clearing and trading houses.

Want to spend a day watching him trade? He doesn’t say much, especially when the market is really moving, but he is only too happy to share his many secrets when he has a spare minute between scanning more than 60 stock charts and watching for volume breakouts on another stock list. That will set you back $5000, but his students know they will always get their money’s worth.

His system is not for the faint of heart. As Dan says using a racecar analogy, “I like to drive at 180 miles-per-hour inches from the wall,” when describing his high velocity 2:1 margin trading style. He is constantly on the lookout for the high beta movers he calls his “frisky buddies.”

“I want to find the market leaders, the up and comers and I only trade them. If it’s not moving higher, I’m not interested.” Contrary to popular practice, he steers clear of bargains. “Why buy a stock that will go up $5 or $10 if you are lucky when there are stocks that will move $30 – $50 in the same time frame?”

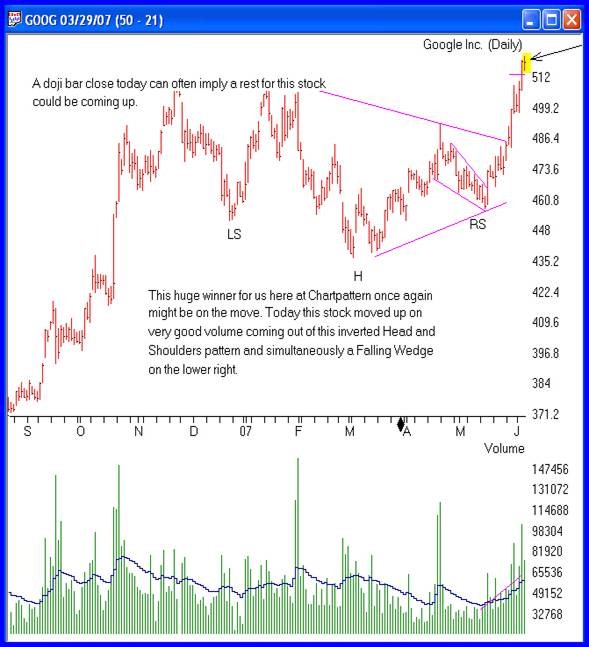

Figure 1 – Google, one of Dan Zanger’s regular favorites, has been featured in countless issues of his Zanger Report issued 4 times per week and holds the record of his single most profitable trade and largest holding. Here we see his analysis and notes on the chart patterns the stock is exhibiting. Provided by chartpattern.com

Mixing It Up: Technicals + Fundamentals = Consistent Winners

Zanger takes a top-down approach when looking for stocks to buy. First he looks for stocks putting in “interesting chart patterns on increasing volume.” If the stock is acting frisky, there is generally a fundamental reason why; often institutions are accumulating the stock and the chart pattern is simply proof of this.

A one-time student of William O’Neil, founder of the Investors Business Daily newspaper dynasty, Zanger has paid his dues. He spent more than 10 years logging 20 or more hours per week (on top of his day job) studying chart patterns. Like a Top Gun fighter pilot looking at enemy aircraft silhouettes until they can identify them in their sleep, Zanger internalized a myriad of chart patterns until he could pick them out in an instant.

A breed apart from most traders who are either technical or fundamental, Zanger uses O’Neil’s CANSLIM formula discussed in his bestselling book, How to Make Money in Stocks: A Winning System in Good Times and Bad. O’Neil recommends that you buy only companies exhibiting certain fundamental and technical characteristics. Zanger has added some of his own criteria, and, interestingly, he has discovered over the years that stocks demonstrating interesting chart patterns on volume very often turn out to fulfill most if not all of the CANSLIM criteria. Here is a summary of the CANSLIM criteria, including the way Zanger uses them.

Current Quarterly Earnings/Share Growth – This must be up a minimum of 40% and quarterly sales accelerating at 40% or better to capture Zanger’s interest. O’Neil recommends, earnings must be up 18 – 20% and sales accelerating at 25% but this just isn’t good enough for Zanger. He also needs to see companies with both earnings and revenues that demonstrate a continual quarter-over-quarter sequential expansion, a process he refers to as “ramping up.” Retailers are a little different and he looks for year-over-year expansion due to the seasonal industry characteristics.

Annual Earnings Growth – Studies by Investor’s Business Daily have shown that winning stocks over the last 50 years had a return on equity (ROE) of 17% or more. Any CANSLIM-worthy stock should demonstrate this kind of ROE in each of the last three years. The higher the annual growth, the better the candidate.

New Products, New Management, and New Highs –This feature combines fundamentals and chart technicals. Companies offering new products/services, with new management and/or industry innovations are prime candidates. Technically, Zanger only buys stocks that are emerging from basing chart patterns and that have put in a new high out of the base or consolidation pattern. It is also important that they have a global domination in their market space and are “under-known and under-owned.” This means that institutions that don’t yet have these stocks in their portfolio are going to become major buyers, at which point they create demand for the stock and this in turn pushes up the stock price.

Supply and demand in share volume/shares that float – Shares outstanding is of less importance here than demand but Zanger likes to see no more than a maximum of 75 – 100 million shares. The total number of shares that the public can buy is known as the float. A small number of shares that float means that fewer shares have to be bought to push up the stock price. TASR, one of Dan’s big winners in 2003-2004, it started out with a float of just 3 million shares. The stock made a 5000% move in 18 months and now has a float of 54.3 million due to numerous stock splits. A stock should demonstrate increasing volume as price moves out of a basing chart pattern such as a cup and handle, saucer bottom, or inverted head and shoulders bottom. Other patterns such as flags or pennants, ascending triangles, bullish diamond patterns and bullish wedges also represent excellent buying opportunities when greater-than-average volumes accompany the breakouts.

Leader (or Laggard)? – Buy market sector and industry leaders. Sell laggards. Own the industry leaders and sell them when they no longer lead. This also applies to the sectors and groups in which they reside.

Institutional – Dan look for stocks with a high potential of institutional participation. Ideally, he wants to find stocks that institutions are beginning to accumulate. This includes those with a higher degree of corporate executive insider ownership.

Market direction – Seventy to eighty percent of a stock’s price movement is determined by the direction of the overall market. Even a winner will be fighting a strong current to get to higher prices in a market that is tanking. It is best to be long big winners in a bull market (and short losers in a bear market) and never fight the trend unless it is giving strong signs of a potential turn around. Catching a bottom is great when you can do it, but if wrong it’s like trying to catch a falling knife, it can also be extremely detrimental to your (financial) health!

Which stocks have been some of his big winners? Other than Taser (TASR), some of his big winners in 2003 -2004 included Research in Motion (RIMM), E-Bay (EBAY), Sina Corp (SINA), Sandisk (SNDK), Chicago Mercantile (CME), Kmart (KMRT), which is now Sears Holdings (SHLD), Apple Inc. (AAPL), Travelzoo (TZOO) and of course Google Inc. (GOOG). In 2005, it’s Google (GOOG) again and he says this stock could just keep running, has been one of his consistent “leader” stocks and has been his largest single position in years.

He was short EBAY when it broke down in January 2005, dropping from a pre- 2 for 1 split price of $103.50 to $83 in one day after an earnings shortfall. It was his biggest single one-day gain on one stock ever as he was short 160,000 shares prior to the earnings news.

Zanger offers a key caveat. Most of the stocks that he trades are high-growth market leaders, but there are two key exceptions that show why checking company fundamentals is so important. First, Biotechs often act like high-growth stocks but don’t have earnings growth and other positive criteria. Second, near the end of a major bull run in the markets, after most of the quality stocks have already moved and are starting to exhaust themselves, the trash stocks will get pushed higher as investors scramble to find the “next big thing.” A rising tide lifts all boats including those that don’t have the fundamentals behind them. Loading up on these trash stocks late in the game can lead to serious losses and a situation that can be avoided by looking at the fundamentals.

Adding Some Perspective

Zanger’s high-speed trading method is not for everyone. Any system that offers big potential wins also works in reverse and Dan is the first to attest to that. Get caught in a stock that does an abrupt about face and the game turns into a survival of the fastest to reach the exits. But like all successful traders, Zanger has had to learn how to limit losses while maximizing profits and he doesn’t let his bad days get him down for long.

Internalizing your trading rules and patterns is also critical to success. Besides How to Make Money in Stocks, two other books that are absolute essential parts of trader education in his opinion are Reminiscences of a Stock Operator and Encyclopedia of Chart Patterns. His daily newsletter is also very useful for those who are interested in getting his input on the market and stocks making moves.

It is also important to take your own personality into account. By his own admission, Zanger is a type “A” personality and needs the thrill of the chase to keep his interest. He thrives on the high adrenaline rush of trading fast moving stocks. Others might consider this stressful but it’s not just the best game, it’s the “only” game in the world to him.

But then again, that describes a high percentage of successful traders.

Recommended Reading

Blackman, Matt, 2003 The Charts Know it All. Chart Patterns, Trading, and Dan Zanger

Bulkowski, Thomas, 2005 – Encyclopedia of Chart Patterns (Second Edition), John Wiley & Sons,

Lefevre, Edwin, 1993 – Reminiscences of a Stock Trader, John Wiley & Sons

O’Neil, William, 2002 – How to Make Money in Stocks – A Winning System in Good Times and Bad, McGraw-Hill