A daily routine, coupled with weekly analysis, allows you to stay in tune with developing themes and jump on trends early.

Here’s a framework that you can use as your foundation:

1 Hour Before Market Open

Review pre-market price action and finalize your daily focus list of 1-5 names.

If it’s within your style, screen or sort for pre market high % movers, high volume, gaps… as you can do in Deepvue.

Visualize possibilities for how the day may resolve and prepare a game plan for each possibility.

Make sure you have your alerts set for your watchlists and have position sizing, and risk management set for each trade idea.

Also take note of any news events such as FOMC that will occur that day.

If ____ then ____

Be ready for anything.

9:30 AM Market Open – 1.5 Hrs After the Open

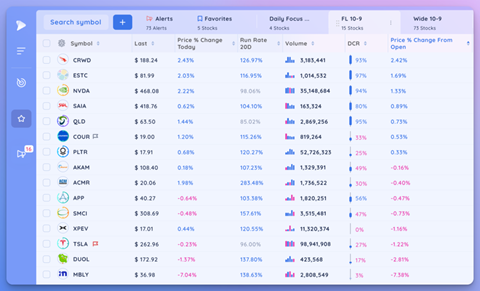

Once the market opens, track the price action of your positions and top ideas. Sort your main watchlists looking for:

• High Relative Volume Movers

• High Closing Ranges

• Strong % Movers

• Strong moves from the open

We like to set these up as columns so you can quickly sort either your watchlists or screens to identify which stocks are standing out and moving with momentum.

We also recommend you use alerts to monitor stocks and top ideas.

The Deepvue alerts contain the key info you need in real time to make a decision.

For instance they have the relative volume factor right their showing the volume compared to that time of day. We also include the Price Surge: The Price % Change of the last 15 minutes.

This way you let the computer do the work for you and have all the necessary information that you need to see if you need to pull up a chart.

During Market Hours

As the day goes on, continue to monitor price action and take notes. You can also take this time to research promising stocks and themes.

Also take any trades as it fits your trading style and game plan.

1 Hour to the close

Monitor the closes of your positions and top ideas. Note any standout names from your lists and screens. Adjust any positions as needed based on the closing action.

After Market Hours

After the market closes it’s time to prepare for the next day.

Review your actions and complete a daily trade journal. Also Monitor any earnings reports if applicable. Finally, run your daily screens and prepare your daily focus list for the upcoming session.

With this high level framework in mind, let’s dive deeper into how you can sort and screen intraday.

Sorting Screens and Watchlists Intraday

During the day, you should be monitoring your stocks, ideas, and taking notes about rotation, strong groups, weak groups, and any other trends you see.

Let’s dive deeper into a few helpful data points that you can use to sort your screens and watchlists.

• Volume Run Rate

• DCR (Daily Closing Range)

• % Gain

• Above VWAP

Volume Run Rate

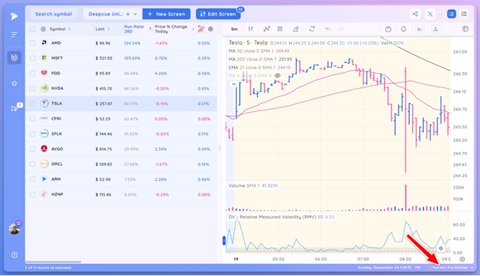

Volume Run Rate is a representation of how volume is tracking versus normal at that instant in time. In Deepvue, we have both a 20 day and 50 day variation.

Our Volume Run Rate Data points will let you see how abnormal volume is at any moment in time, even right at 9:30 after the market opens.

In the first hour, relative volume will let you know which stocks are moving on significant volume, a key indicator that institutions are behind a move and that breakouts may be more likely to hold as well as breakdowns may be more detrimental.

This will give you a step up versus traders who have to guess by just looking at the raw volume to see if it looks abnormal.

Price % Change

Price percent change is an obvious but powerful data point that can point you towards the top and worst performing stocks of the day.

In Deepvue, you can sort by this (or Price % Change from the open) to quickly see the strongest stocks in your watchlists and screens.

Daily Closing Range (DCR)

Daily Closing Range is what top traders use to identify relative strength and strong stocks. It represents the location of the close relative to the range from high to low.

On a negative day in the markets the strongest stocks that day will have high DCRs near 100, even if they may be red on the day.

Above VWAP

VWAP (Volume Weighted Average Price) is commonly used by institutions to enter and manage positions. Stocks under accumulation will consistently trend above this level.

How to use these Data Points.

By adding these data points as columns in Deepvue, you can quickly sort your watchlists and screen results throughout the day to monitor leading names and analyze rotation.

Intraday Screening

Let’s also cover three screens that you can run during the trading day to help fund new ideas and track rotation.

These are also helpful to run after the close to identify strength that day.

Intraday Screens

Let’s cover three screens that you can run during the trading day to help fund new ideas and track rotation

Up On Volume

This is Ross Haber’s go to scan. Simply sorting through stocks that are acting well will enable you to read the pulse of the market.

It will show the best breakouts and strongest stocks each day.

Another great alternative to this is Oliver Kell’s Bull Snort Screen which is another DV preset.

Gap Ups

Each day you should track gap ups, especially on earnings. These may or may not be directly actionable but having them on your radar will allow you to watch for the next setup.

This screen looks for stock with a gap of at least 5% on at least 25% above average volume run rate.

The higher the run rate the better, 25% is a bare minimum

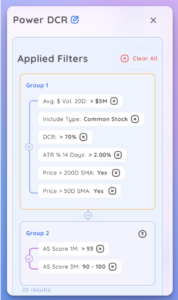

Power DCR

This screen is especially good on down days. It looks for strong stocks in a trend with high closing ranges.

Tracking high DCR stocks points you towards the RS, especially if a whole group is standing out.

Post Market Screening

After the market is closed you should run a subset of your weekly screens that will find any big movers to include on your watchlists.

Then, you should run through your weekly and wide watchlists and build your daily focus list for the next day and jot down any trends or situational awareness thoughts.

The key thing is that you develop a solid plan for the day surrounding your positions and top ideas.

Key Points

The most important thing is that you set up a daily routine that keeps you prepared for each trading day, and on top of actionable ideas and market health.

For traders who work full time jobs, you should make full use of the Deepvue alert system which includes actionable information that gives you the full context of the alert.

Remember, even if you work full time and are unable to watch the market, you can do unbelievably well.